UX and SEO red herrings

SEO is full of Red Herrings, misleading assumptions due to cognitive biases. In this case study, I show what this can look like.

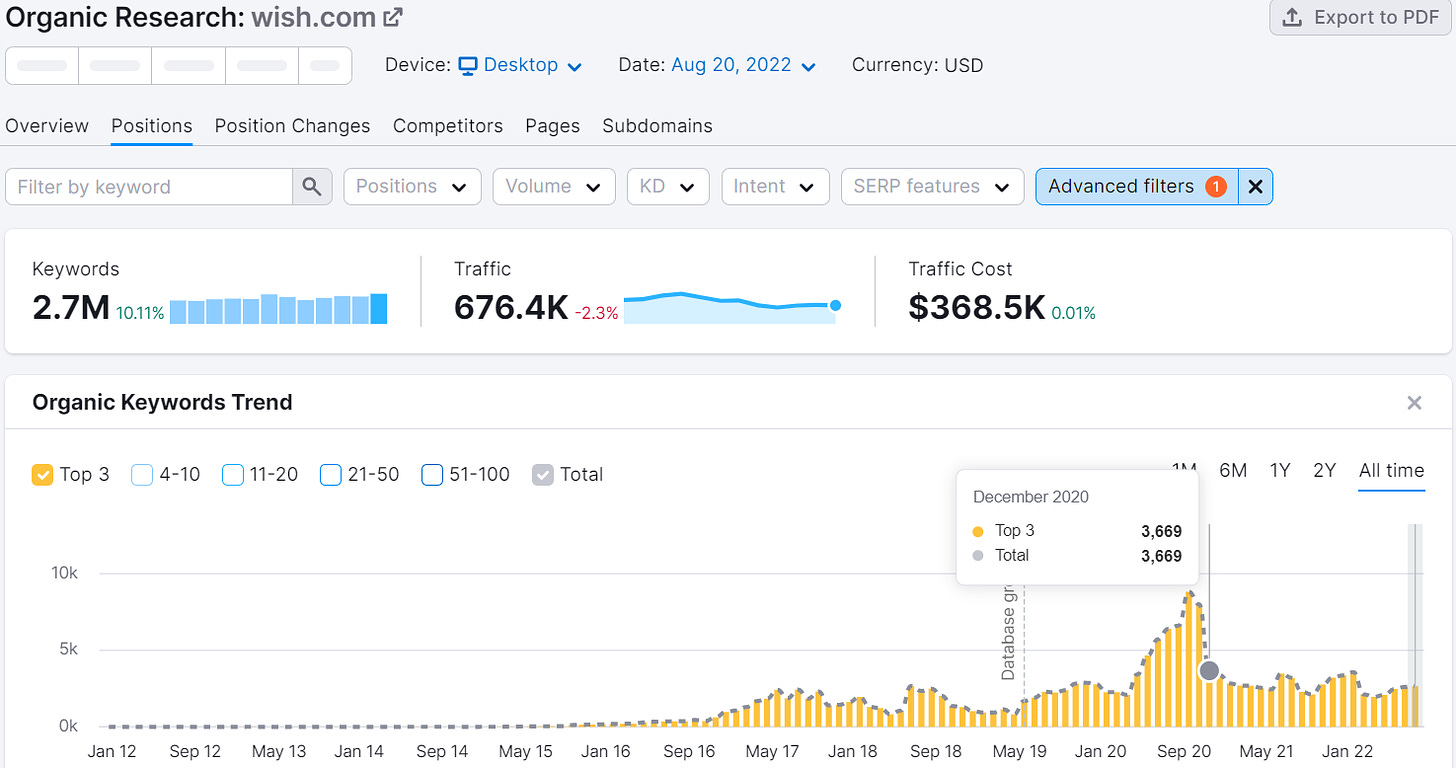

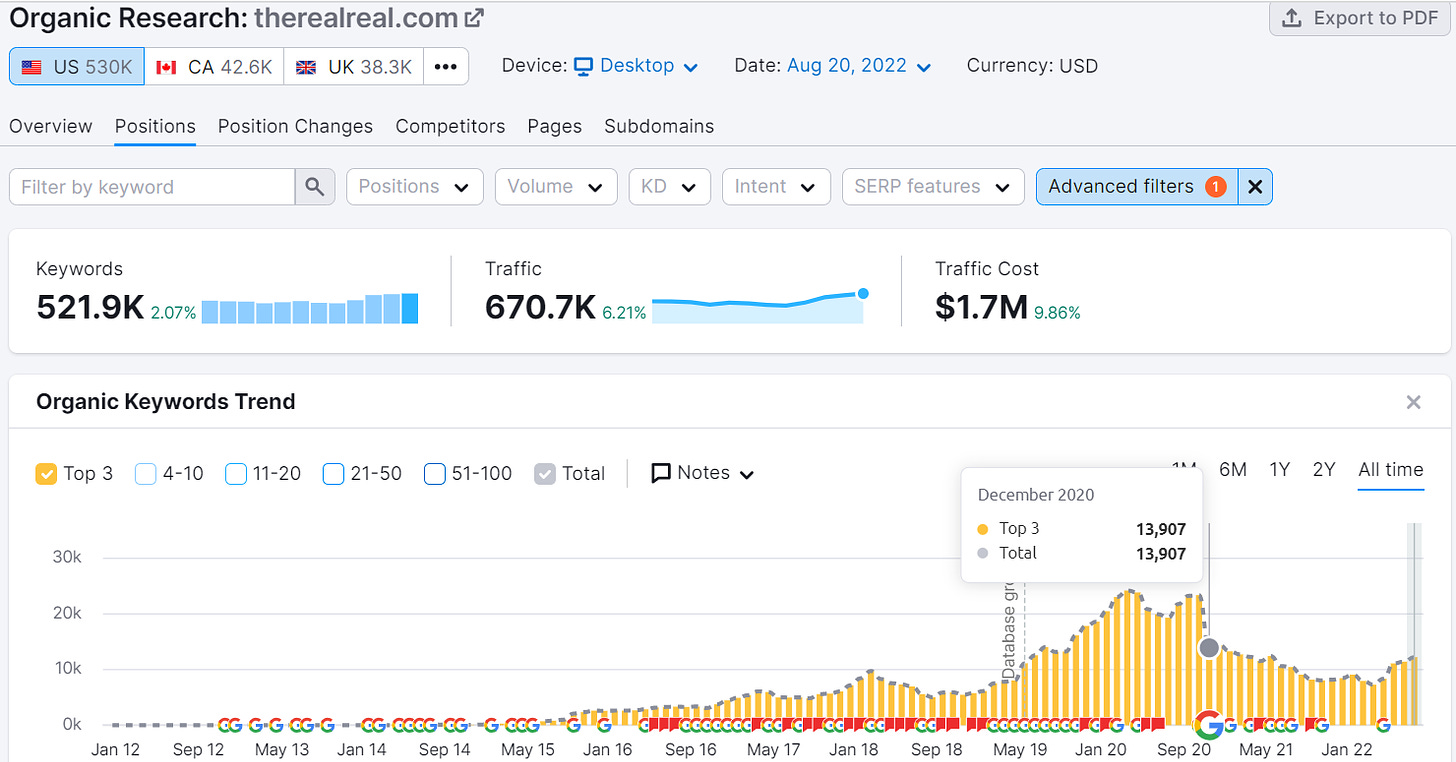

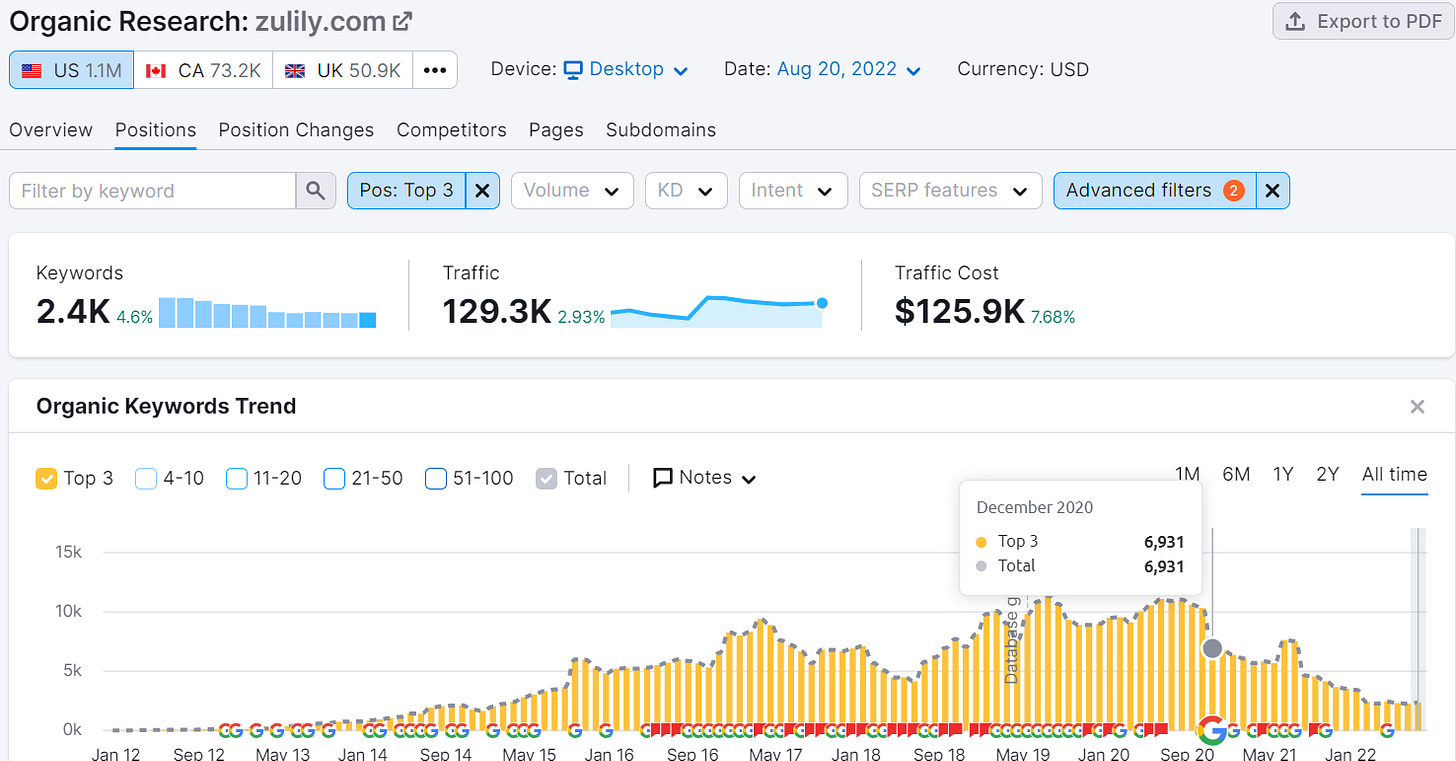

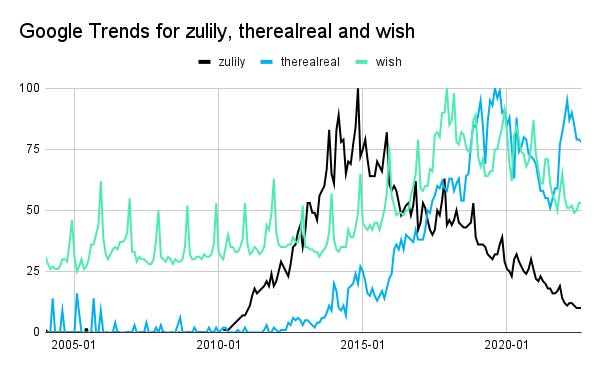

Wish, Zulily, and TheRealReal have a few things in common. They use the same business model. They force users to log in before being able to use their apps. They used to be worth a lot more than they are today, and they lost traffic around the same time.

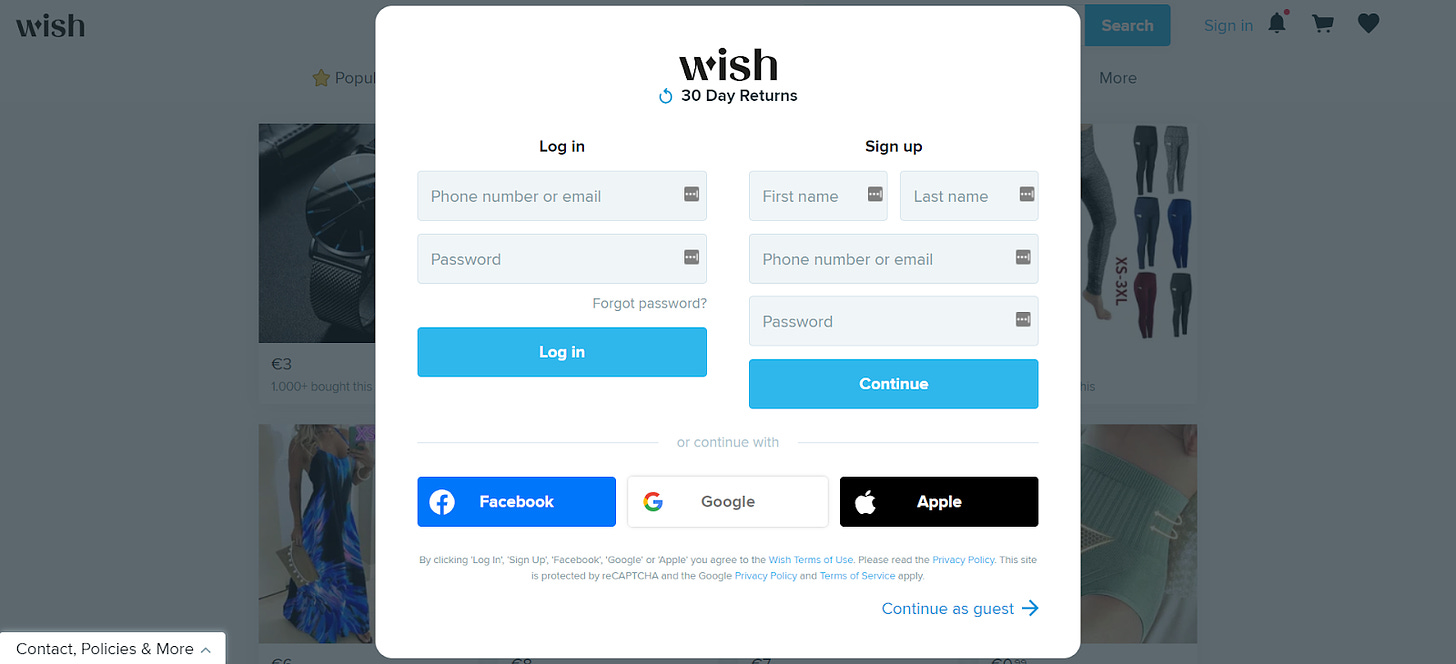

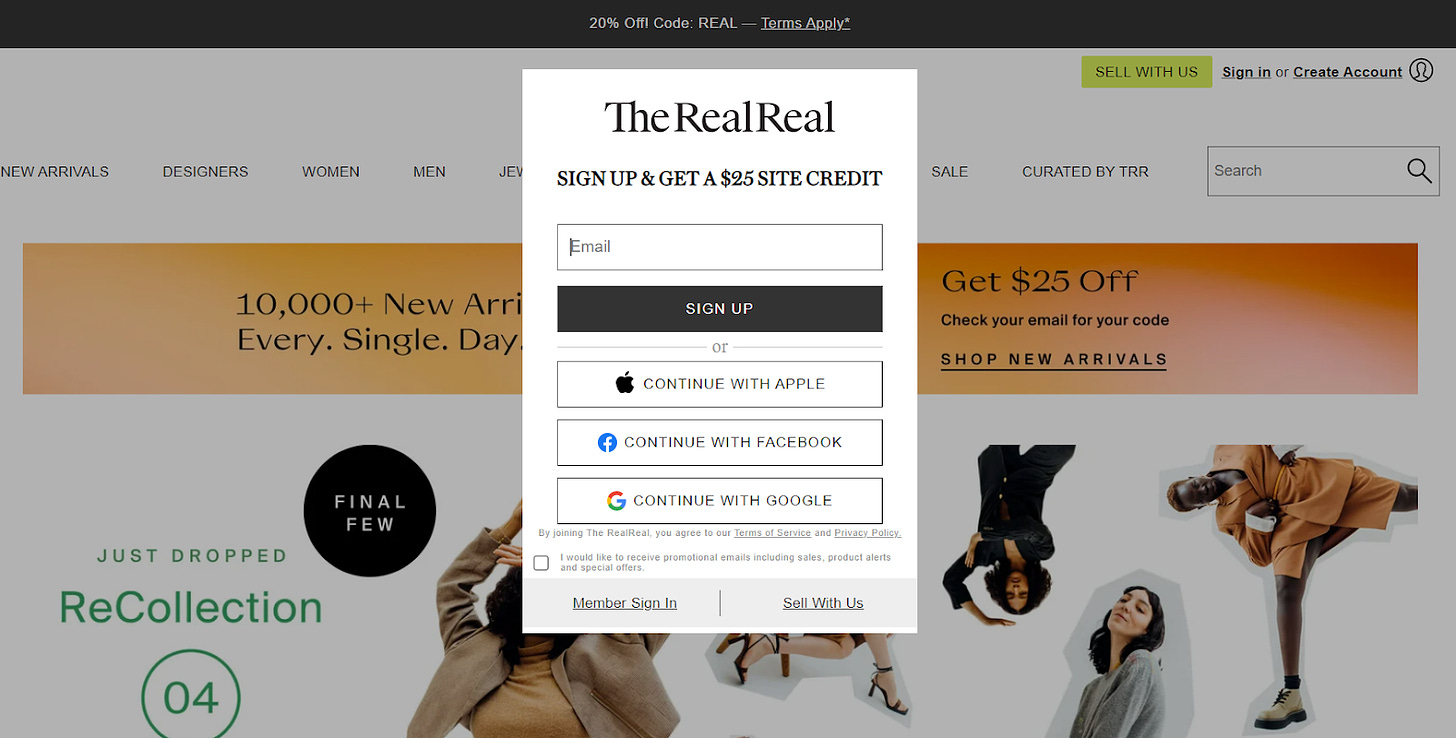

All 3 domains lost traffic during the December 2020 core algorithm update. When I visited the sites, I noticed they forced users to log in. In my logic, this could have sent a negative signal to Google because many users might bounce because they have to log in to use the platforms. Other platforms like Pinterest or Instagram let users consume some of the content before showing a sign-up gate.

Wishful thinking

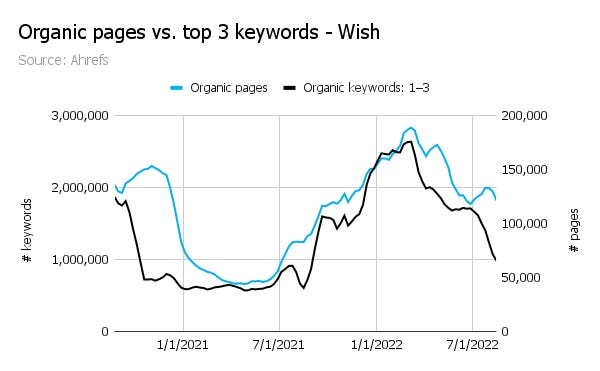

In 2018, the press called Wish “the next Walmart”. Just a year before, it was the most downloaded e-commerce app. What started as a wish list for products turned into a marketplace for flash sales and dropshipped (3rd parties acquire buyers, but manufacturers the products to customers) products. The founder publicly stated that Wish aimed to become a multi-trillion dollar (with a *t*) marketplace.

Then came the downfall. In 2021, the French government asked Google to delist search results from Wish after probing hundreds of products and determining to be counterfeit. Wish sells smaller items that are cheaper and faster to ship at high discounts. [x]

Initially, Wish spend $100m/year on Facebook ads with a high level of precision for personalization. The USP is hyper-personalized results, a legacy of its founders who previously worked at Google, and the reason users need to log in. [x]

Today, Wish gates the platform for new users, but allows them to continue as guests. Wish.com gets less than half the organic traffic they had before the December 2020 update.

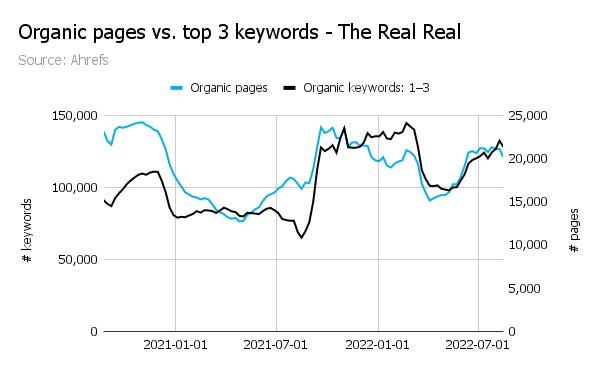

TheRealReal, a second-hand designer clothing marketplace, followed a similar path. In 2019, they were worth $28b. In August 2022, market cap hit 222 million USD.

The business model is recommerce: TheRealReal vets, buys, and curates products. But during the pandemic, it became difficult for customers to bring their clothes to one of TheRealReal’s local retail stores. TheRealReal introduced more partnerships to its marketplace and offered products directly to customers instead of promoting resales. [x]

Today, TheRealReal’s site forces users to sign-up before buying from the marketplace. Organic traffic halved after the December 2020 update.

Zulily sells kids' toys and clothing to young mothers. Like Wish, it relies on flash sales to drop prices. In 2013, Zulily went public at a $9 valuation but struggled to expand its market to new customers. A few years later, they sold for $2.4b to QVC, whose teleshopping business model is very compatible to flash sales.

Zulily’s site also forces users to login. Organic traffic dropped to 50% after the December 2020 algo update and never fully recovered.

The Red Herring

Punishing forced sign-ups makes sense in theory but is a Red Herring. When digging deeper, 4 reasons for the traffic drops come to light that make more sense.

First, all 3 sites show a strong relationship between the # top 3 keywords and # pages (screenshots below), a common pattern for aggregators. Marketplaces show stronger relationships between the number of pages and organic keywords because they scale with (product) inventory. Pages have a specific search intent, which leads them to correlate stronger with the number of ranking keywords.

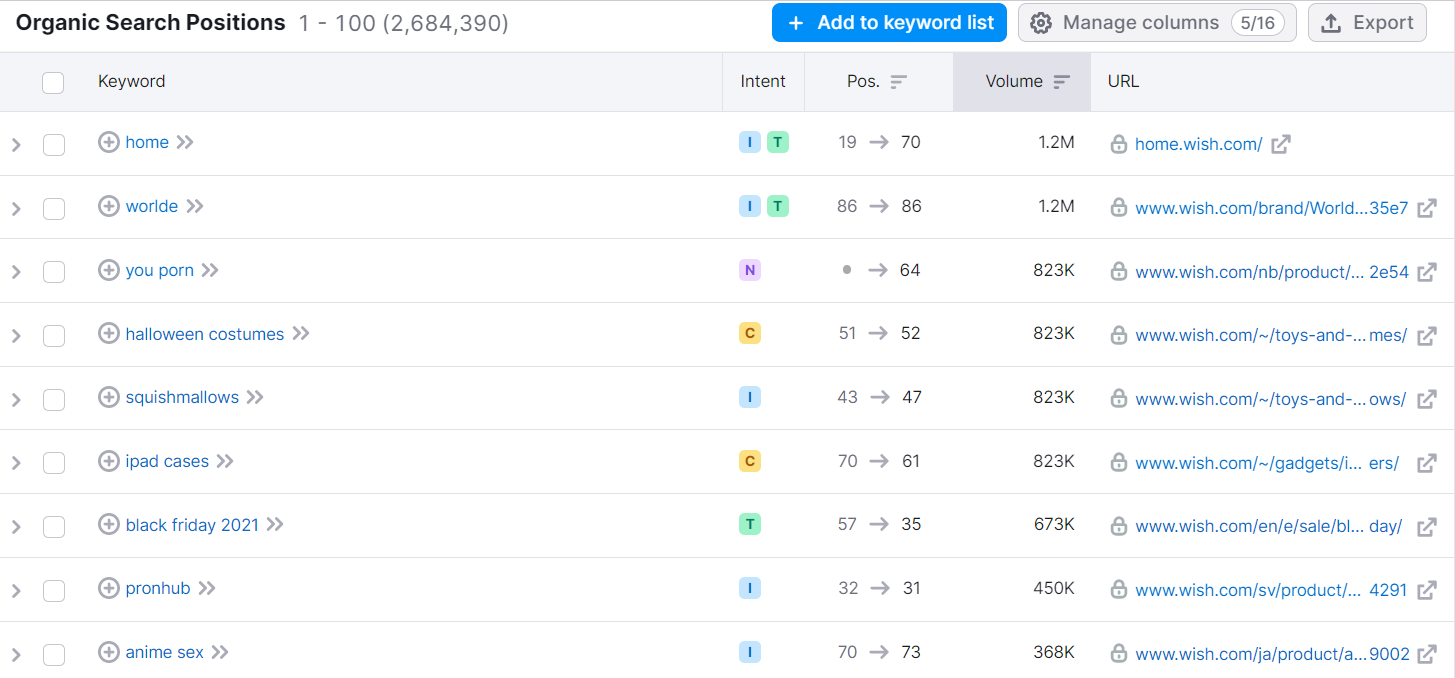

Second, Wish sells erotic products that *could* send negative signals to Google. The visibility of adult content and products is intentionally kept out of Google’s search results.

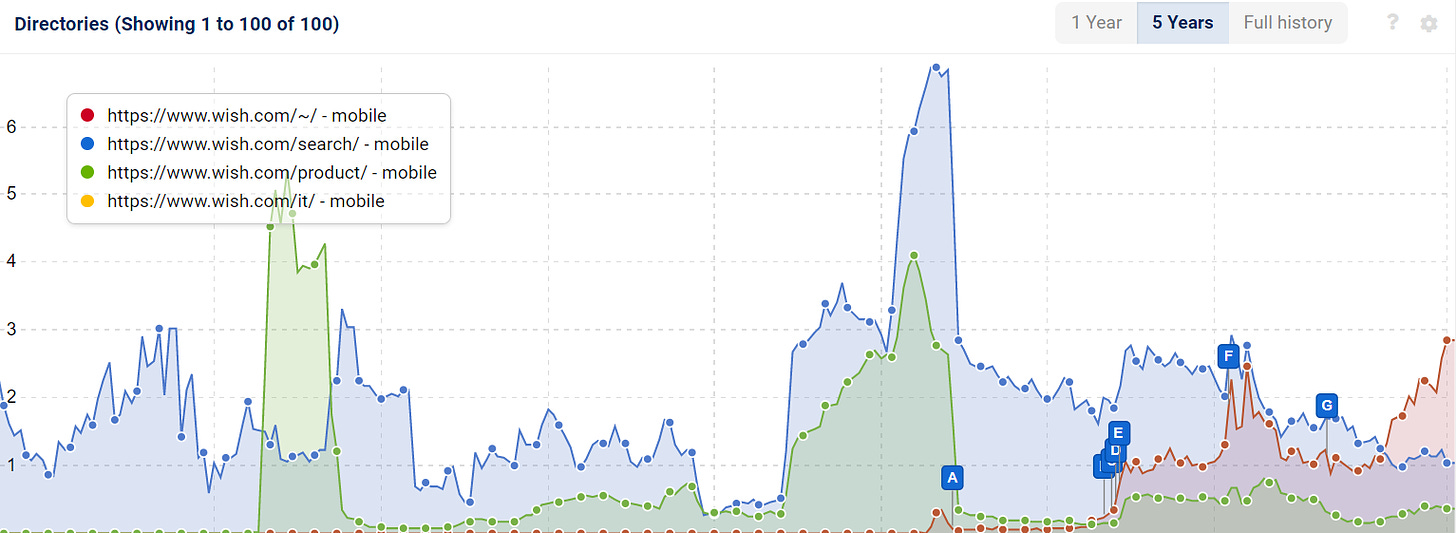

Third, Wish ranks with search pages that continuously lost the most visibility since the December 2020 core update. That’s much more likely the reason for the decline than forced sign-ups since the Google guidelines clearly say to avoid indexing and ranking with search pages.

Fourth, all 3 brands have declined in brand searches (for context: I filtered brand keywords out of the Semrush screenshots above). Brand search can be a proxy for product market fit and brand awareness. Zulily, TheRealReal, and Wish all seem to have lost trust and brand awareness over the last years, probably partly because of scandals around counterfeit products.

Fifth, other ungated sites with the same business model show similar visibility issues around the December 2020 update. One example is thredup.com (screenshot below), which lost and gained at the same time as therealreal.com.

Second thoughts

I wrote this post to create awareness for Red Herrings and the trap of going with your first answer. SEO is full of these traps because so many factors are at play, and our cognitive biases are strong. They make us see problems where there are none, which in return costs us credibility and diminishes our chances of success.

I want to add that it's harder to tell what's going on from the outside. A final call can only be made with more data and a deeper analysis.